Starting April 01, 2026, these businesses must integrate their e-invoicing systems with the FATOORA platform. This integration is part of ZATCA’s ongoing efforts to enhance the efficiency and transparency of the tax system, ensuring real-time processing and validation of electronic invoices.

Businesses within this revenue bracket must prepare to align their invoicing processes with the technical and procedural requirements outlined by ZATCA. This includes ensuring their systems can generate, store, and exchange electronic invoices that comply with the specified standards.

Integrating the FATOORA platform is expected to streamline tax compliance, reduce the administrative burden, and minimise errors associated with manual invoicing. ZATCA encourages all affected businesses to begin their preparation well before the deadline to ensure a smooth transition and avoid any potential penalties for non-compliance.

This announcement underscores ZATCA's continued commitment to modernising tax administration in Saudi Arabia, fostering a more robust and transparent economic environment for businesses.

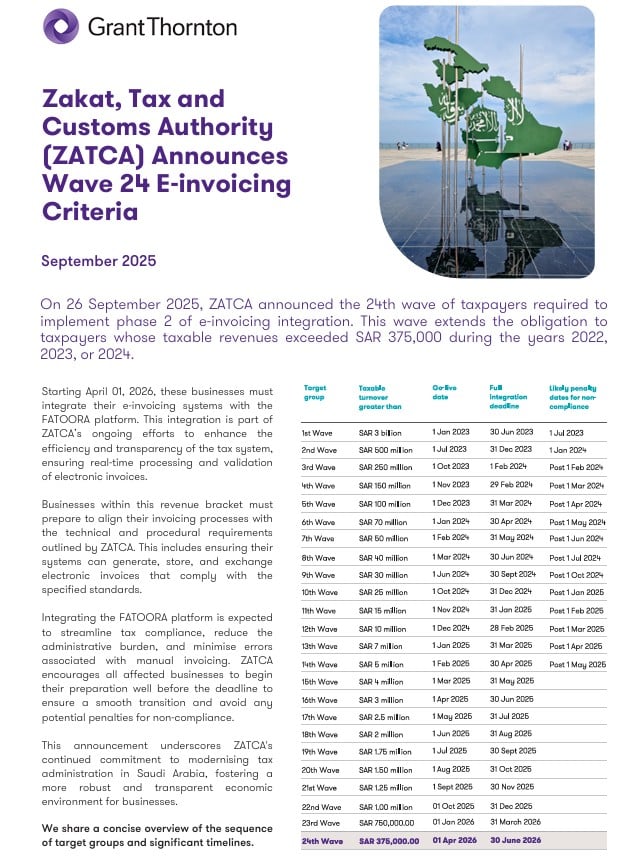

Review the full schedule below.

Wave 24 Implementation of E-Invoicing in Saudi Arabia

We are providing a quick summary of sequence of target groups and important timelines.