-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

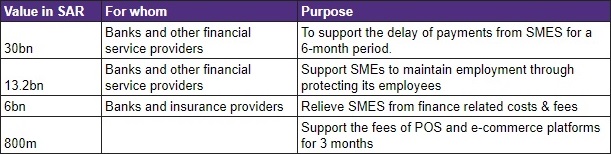

Taking into consideration the current unprecedented period which the world is experiencing, the authorities within the kingdom have introduced austerity measures which will support business leaders and SMEs across the country, which include:

Tax Amnesty:

The General Authority of Zakat and Tax (GAZT) have provided further reprieves which will remain until 30 June 2020, which include:

- Payments can be made through instalments subject to approval by the authority

- Deferral period of 30-days for the collection of custom duties on imports for three months from Mar 2020, provided a bank guarantee is submitted.

- Penalties for late registration will be removed from the period of 18 Mar to 30 Jun 2020

- Refunds which are outstanding will be expedited by the authority

- Corporation and Zakat certificates will be issued without restrictions for the fiscal year 2019

Tax deferrals:

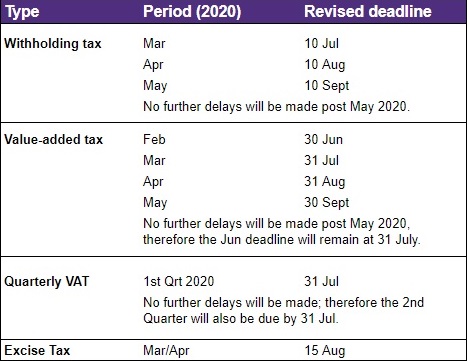

Zakat, Corporate Income, Excise and Value Added Taxes have been delayed for a three-month period, with the revised deadlines summarised below.

As well as having skills and experience in tax consulting and compliance, our teams can support you with direct international tax, global mobility services, indirect tax, private client services, transfer pricing, zakat and tax compliance. There is continuing uncertainty and tax compliance is vast and complicated. We can help businesses make sense of their tax position and ensure they’re ready for the new order.

Across the globe, companies’ tax affairs are facing increasing scrutiny from regulators, communities and clients. At the same time, bodies such as The Organisation for Economic Co-operation and Development (OECD) are working on rules to change the way international business structures work.

A positive tax strategy can also increase your reputation for openness and transparency among communities, helping your business stay ahead. To discuss your Zakat and Tax requirements contact our team.