-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

-

Supply Chain and Operation Services

An optimised and resilient supply chain is essential for success in an ever-evolving business landscape

-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Deal Advisory

At Grant Thornton, we deliver deal advisory services through a strategic lens, providing end-to-end support that enables our clients to unlock value, manage risk, and make informed decisions with confidence. Our team works closely with businesses across Saudi Arabia to navigate the complexities of transactions and drive smart, sustainable outcomes.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

Today’s global markets are more complex than ever. With compliance, transparency and regulatory demands increasing worldwide, every business needs to have a comprehensive, efficient tax strategy in place.

Within the Kingdom of Saudi Arabia (KSA), all entities who are not resident and trade or provide services across the Kingdom are subject to withholding tax (WHT), often referred to as retention tax, as confirmed by The General Authority of Zakat and Tax (GAZT).

According to the Implementing Regulations (“IR”) of the Income Tax Law, WHT shall be imposed on the total amount paid to the non-resident entity, notwithstanding expenses incurred to make the income; full allowances/ disallowances, as a deduction, of such payment.

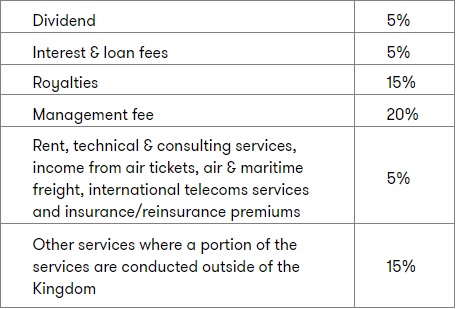

Unless agreed under a tax treaty, the withholding tax rate applicable for non-resident entities is summarised as follows:

Contractual and invoice implications to consider:

Often service providers are not aware of the tax structure across the Kingdom, therefore the notion of withholding tax is often omitted from the contractual agreement and invoicing. It is important to understand your tax obligations, ensuring this is effectively documented and accounted for aside from the original fees agreed. Failure to do so could result in the service provider having to bear losses of up to 15% of the fee value.

Obligations and penalties:

The withholding person should retain records which demonstrate its compliance with the withholding provisions provided that they have at least the name and address of their beneficiaries, the type of payment, the amount, and the amount deducted in addition to any supporting documents for at least ten years after payment.

A penalty of 1% of the unpaid tax for every 30 days of delay from the due date shall be imposed for non-payment of the withholding tax. An additional penalty of 25% may be levied to the unpaid tax, should authorities suspect tax evasion.

Submission requirements of the withholding person:

- Monthly return within the first ten days of the month following the month during which payment to the non-resident party was made.

- The withholding person is required to file the return through its account on GAZT's website.

- An annual return is also required to be filed within 120 days of the year end, and not later than 60 days of the year-end for partnerships.

As well as having skills and experience in tax consulting and compliance, our teams can support you with direct international tax, global mobility services, indirect tax, private client services, transfer pricing, zakat and tax compliance.

Across the globe, companies’ tax affairs are facing increasing scrutiny from regulators, communities and clients. At the same time, bodies such as The Organisation for Economic Co-operation and Development (OECD) are working on rules to change the way international business structures work.

A positive tax strategy can also increase your reputation for openness and transparency among communities, helping your business stay ahead. To discuss your Zakat and Tax requirements contact our team.