Services

We offer a comprehensive range of advisory services to help you create, transform and protect value.

-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

Related insights:

Women in Business 2024

Pathways to Parity

2024 marks the 20th year of Grant Thornton’s work to monitor and measure the proportion of women occupying senior management roles in mid-market companies worldwide.

The Women in Business project has explored what helps and hinders women in the workplace during a period that has offered plenty of challenges. Global mid-market companies have navigated the financial crisis of 2007-08, worked through the pandemic, and currently contend with the impact of geopolitical tension and conflict.

We have the scope, depth, and global reach to serve businesses who are positioned to thrive in Saudi Arabia. Our team provide you with assurance services that...

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

Our experienced tax team not only support core compliance but are at the leading edge of transformation and operational resilience in respect of the tax...

Energy & resources

Optimism is slowly returning to the global economy, but the financial services industry needs to regain the trust of public and private bodies. To succeed,...

Emerging markets and shifting consumer demand are creating new opportunities in consumer products, with business leaders investing in new products, markets and...

Dynamic businesses need to move with speed and purpose if they want to capitalise on opportunities in travel, tourism & leisure. At Grant Thornton, we know...

Demographic, organisational and resourcing issues are radically changing the global healthcare industry. Worldwide, we have a long and varied list of clients,...

We work with all types of agencies, including central and state government, local government, donors (including bilateral and multilateral international...

While the impact of the prolonged downturn continues to be felt, pockets of opportunity and optimism have emerged within the retail estate and construction...

Rapid change and complexity are norms, and innovation the fuel in the technology industry. Today’s revolutions – including cloud, as-a-service, social media...

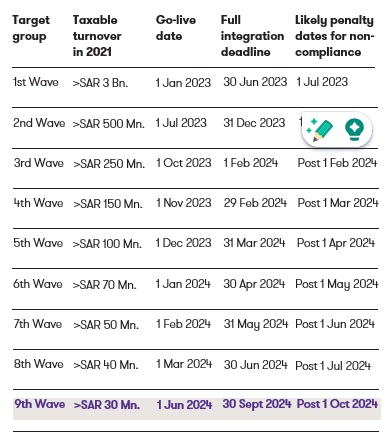

Following the recent announcement by ZATCA (The General Authority of Zakat and Tax) on November 17, 2023, through Umm Al Qura issue No. 5007, the 9th wave of taxpayers has been identified for implementing Phase 2 of e-invoicing. This wave now includes taxpayers whose taxable revenues exceeded SAR 30.00 Million during 2021 or 2022.

Contents

If you meet the specified criteria, you are required to integrate your e-invoicing solutions with the FATOORA platform offered by ZATCA. This integration process must begin no later than June 1, 2024. Additionally, you must create designated fields within your database and tax invoices to facilitate smooth integration and compliance. Your tax invoices should be generated in either XML format or PDF/A-3 format with embedded XML.

We share a concise overview of the sequence of target groups and significant timelines:

“In light of the rapidly evolving landscape of business transactions and digital economies, it has become imperative for businesses in the Kingdom of Saudi Arabia (KSA) to embrace e-invoicing as a transformative tool. E-invoicing not only streamlines financial processes but also significantly enhances operational efficiency. By automating invoicing procedures, businesses can reduce manual errors, accelerate payment cycles, and optimise resource allocation."

Adel Daglas, Head of Tax

Grant Thornton, Saudi Arabia