The General Authority of Zakat and Tax GAZT announced the approval of its Board of Directors on the electronic invoicing regulation, which was published on Friday, the December,4 2020. As per the regulations, the definition of an electronic invoice is a tax invoice which is issued electronically and by every taxpayer subject to value added tax in the Kingdom.

The electronic invoicing regulation contains seven articles that regulate the mechanism for issuing and keeping electronic invoices for the taxpayers, and clarifies the provisions, procedures, and persons subject to them, in addition to the procedural rules and legal time limits.

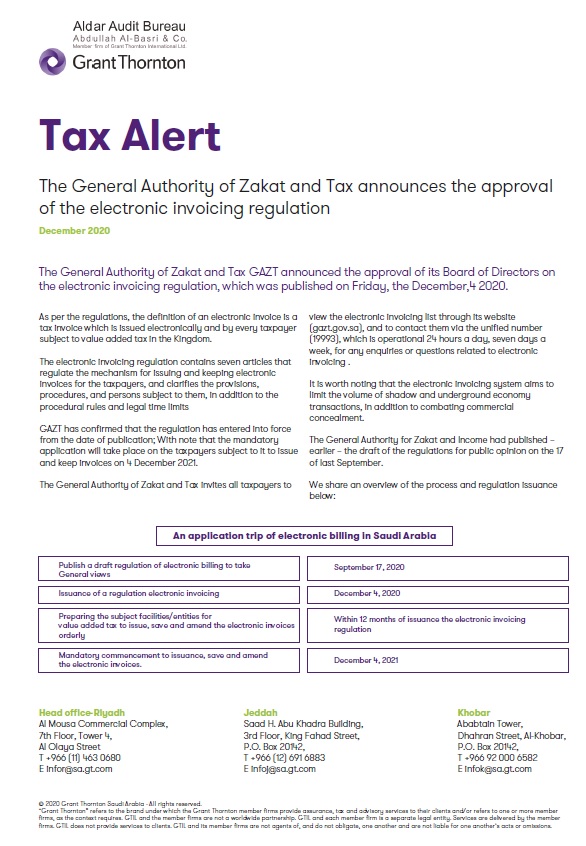

GAZT has confirmed that the regulation has entered into force from the date of publication; With note that the mandatory application will take place on the taxpayers subject to it to issue and keep invoices on 4 December 2021.

Download the alert [ 68 kb ] to read further or contact our technial expert, Adel Daglas