-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

The General Authority of Zakat and Tax GAZT announced the approval of its Board of Directors on the electronic invoicing regulation, which was published on Friday, the December,4 2020. As per the regulations, the definition of an electronic invoice is a tax invoice which is issued electronically and by every taxpayer subject to value added tax in the Kingdom.

The electronic invoicing regulation contains seven articles that regulate the mechanism for issuing and keeping electronic invoices for the taxpayers, and clarifies the provisions, procedures, and persons subject to them, in addition to the procedural rules and legal time limits.

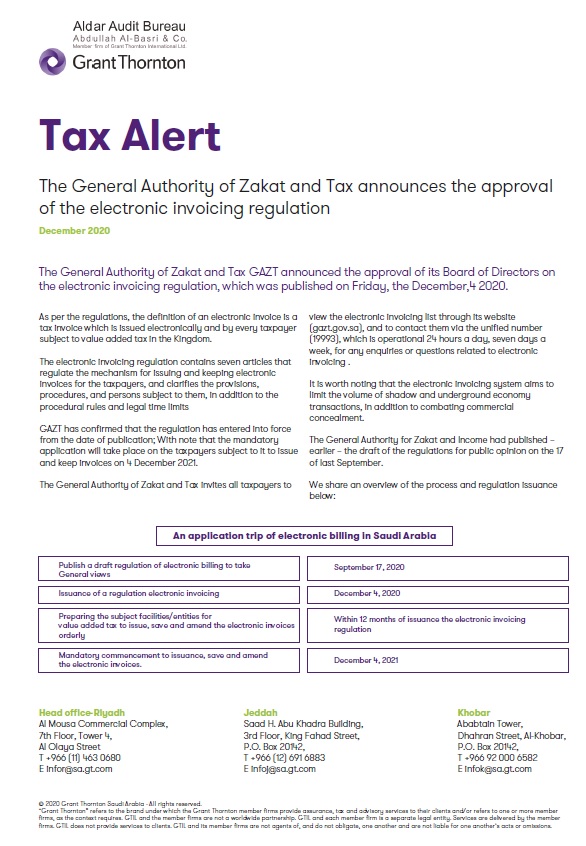

GAZT has confirmed that the regulation has entered into force from the date of publication; With note that the mandatory application will take place on the taxpayers subject to it to issue and keep invoices on 4 December 2021.

Download the alert [ 68 kb ] to read further or contact our technial expert, Adel Daglas