-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

-

Supply Chain and Operation Services

An optimised and resilient supply chain is essential for success in an ever-evolving business landscape

-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Deal Advisory

At Grant Thornton, we deliver deal advisory services through a strategic lens, providing end-to-end support that enables our clients to unlock value, manage risk, and make informed decisions with confidence. Our team works closely with businesses across Saudi Arabia to navigate the complexities of transactions and drive smart, sustainable outcomes.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

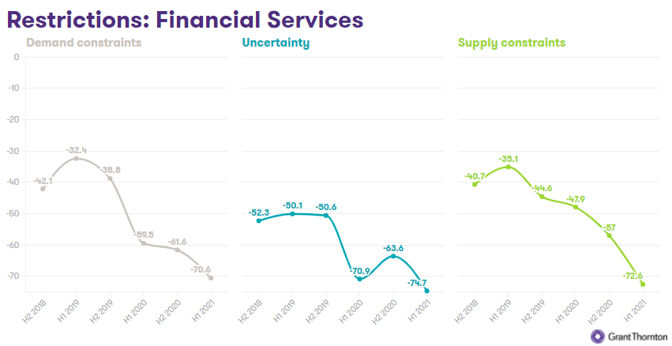

Supply and demand constraints dragged on the overall FS industry, despite a sharply improved outlook rising to 62, close to the record high of 64 in early 2017. Increasing optimism and improved conditions and investment supported the outlook, as economies started to open and other industries begin to look for finance to help them recover and grow.

While asset management was the most buoyant within the FS industry, banking has shown resilience over the past year, and optimism within the sector is in line with the global average. Banks' growth expectations for the next 12 months were above the global average.

The greater part of the Saudi Arabian banking industry enjoys a good financial position and strong franchise, with a stable outlook for the industry's average D+ financial strength rating1. Additionally, the industry is focused on shifting towards digital banking, which has further supported the industry growth.

Globally, banks expressed concern about a shortage of finance, with 75% citing the availability of finance as a constraint, up from 61% in H2 2020. While this is not a concern in all jurisdictions, particularly in the US, it is a cause of contraction in some markets. Stephen says: “We are in a world where new entrants can get money more quickly and easily than banks, so that shortage of finance is an issue. And it’s why several banks are leaving the market in Ireland, for example.”

Another critical constraint is the supply of talent, with 73% of mid-market banks saying it was a significant constraint on growth.

Graham Tasman, risk advisory and banking sector lead at Grant Thornton US, says that there was already a need to transform skills within the sector before the pandemic. “If you’re going to offer new products and services, the labour and capabilities required to achieve that change are more technology-informed. It’s hard to find skilled people who understand banking, understand the products, can do commercial client relationship management, and also have a sufficient degree of technology awareness to drive the level of digital transformation in this new world.”

“The mobility constraints imposed by the global pandemic have shown that there’s more willingness to bank online across all generations; it’s not just younger people anymore. That may force more R&D in online and digital solutions and start to make institutions think about further limiting their retail footprint because that is a big cost item.”

Economic uncertainty remains a concern for the banking sector with 45% of the sector citing it has major constraint. Stephen Tennant notes: “While there is optimism within banks there is nervousness and uncertainty too on concern about which sectors are going to bounce back. While manufacturing, professional services, technology all seem to be rebounding robustly, there is concern around how long it will take retail, hospitality to recover and how well provisioned the banks are to cope with that.”

To discuss the industry insights further, contact Imad Adileh, Principal and International Business Director.

1 https://gulfnews.com/uae/saudi-banks-in-good-financial-position-says-moodys-1.414449