-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

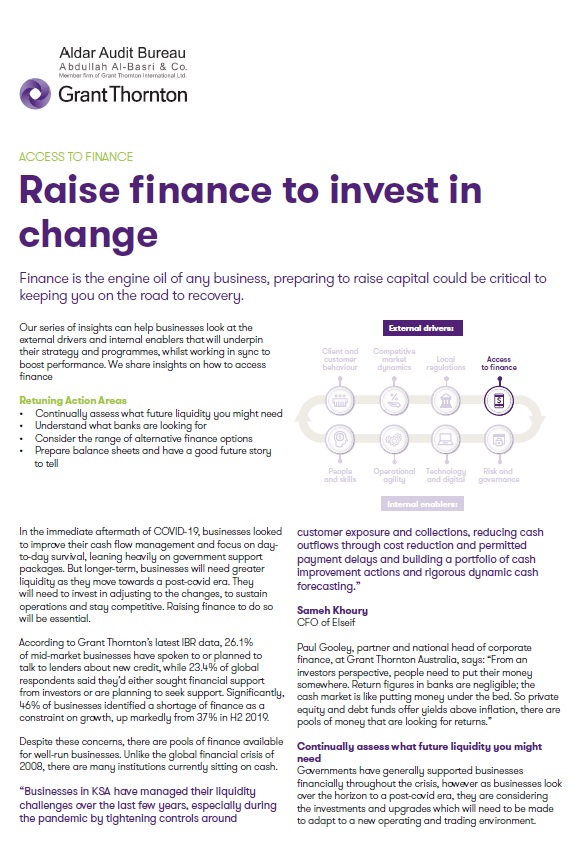

In the immediate aftermath of COVID-19, businesses looked to improve their cash flow management and focus on dayto-day survival, leaning heavily on government support packages. But longer-term, businesses will need greater liquidity as they move towards a post-covid era. They will need to invest in adjusting to the changes, to sustain operations and stay competitive. Raising finance to do so will be essential.

According to Grant Thornton’s latest IBR data, 26.1% of mid-market businesses have spoken to or planned to talk to lenders about new credit, while 23.4% of global respondents said they’d either sought financial support from investors or are planning to seek support. Significantly, 46% of businesses identified a shortage of finance as a constraint on growth, up markedly from 37% in H2 2019.

Despite these concerns, there are pools of finance available for well-run businesses. Unlike the global financial crisis of 2008, there are many institutions currently sitting on cash.

Contact our team to discuss how to raise finance.