-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

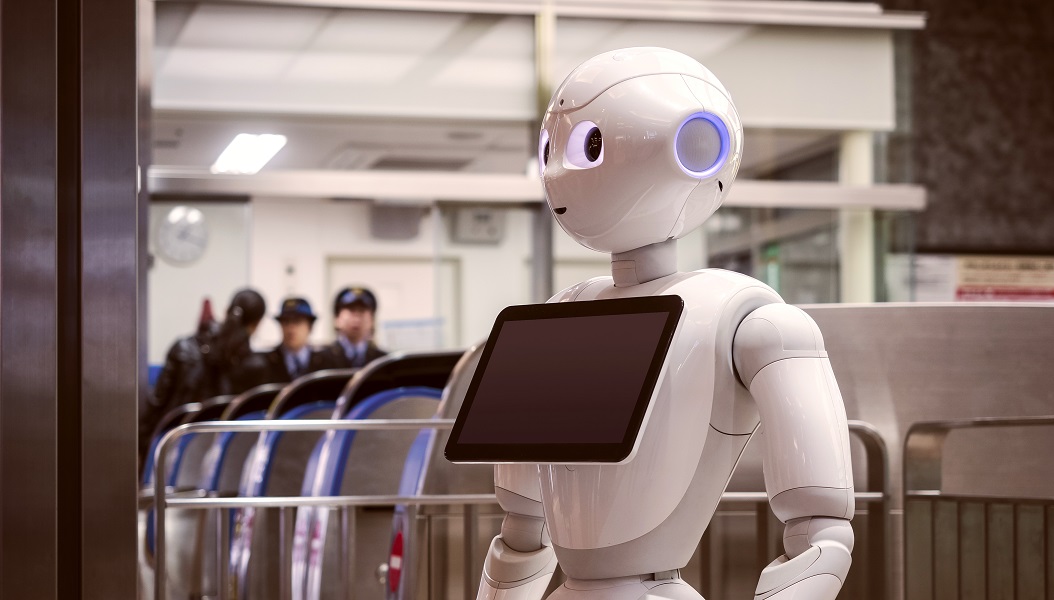

The Saudi government has a substantial mandate for digital transformation. In line with its Vision 2030 objectives, it is heavily investing in shifting economic growth away from a dependency on oil and supporting innovation and entrepreneurship instead.

Imad Adileh, Principal for Grant Thornton Saudi Arabia, said: "Billions of dollars have been invested in high-tech infrastructure, launching funds, and moving ahead with a multitude of economic reforms to strengthen the digital sector. We explore the key sectors which will drive growth as a result of their tech-innovation.

Imad Adileh, Principal for Grant Thornton Saudi Arabia, said: "Billions of dollars have been invested in high-tech infrastructure, launching funds, and moving ahead with a multitude of economic reforms to strengthen the digital sector. We explore the key sectors which will drive growth as a result of their tech-innovation.

Healthcare

The Public Investment Fund (PIF) announced in early January 2021, that they were in discussion with several international companies in the healthcare and technology sectors to set up operations in the Kingdom. To stimulate this sectors growth, the authorities continue to provide an attractive landscape to operate in, with regulatory reforms continuing to take shape in alignment with international best practice. The pandemic further elevated the need to fuel the healthcare industry via technology, to continue driving innovation across the market, whilst addressing the needs of the digital-native youth population across the Kingdom.

Retail and ecommerce

Retail, specifically luxury retail has been a prominent sector across the Gulf markets, which is often referred to as an extension to the entertainment sector. With the extended pandemic measures which included the closure of malls and shopping centres the Gulf population needed a new source of perusing and obtaining goods. This has driven the accelerated growth of e-commerce, with several notable deals taking place in this sector. Several of these deals included NaNa Direct, an online grocery platform who raised $6.6 million. AI and supercomputing start-up UnitX, a spin-out company from King Abdullah University of Science and Technology (KAUST), secured $2 million from the KAUST Innovation Fund and Saudi Aramco’s Wa’ed fund1.

Entertainment and Tourism

Saudi Arabia is leading digital transformation spend in the MENA region, holding a 31%+ share of the market in 2019. This trend looks to continue growing as the Kingdom invested in digitizing and innovating the energy sector with megaprojects such as the city of the future, Neom, along with, immense infrastructure investments reaching $1.1 trillion over the next 20 years, which aim to strengthen the contribution of tourism from 3% now to 10% in 20302.

Financial Services

The Saudi Central Bank issued rules for practicing debt crowdfunding activities. It also announced the issuance of the “Open Banking Policy”, which articulates the main objectives of implementing Open Banking in the Kingdom and its positive effects on the financial sector. More recently, the establishment of a bank for SME’s has been approved. The bank will focus on providing all its products and services in a digital form without the need to establish branches, which will contribute to the delivery of services to all promising regions and focuses on applying international best practices. This initiative was in alignment with the national strategy for SMEs and showcases the aggressive and innovative which is being taken across the Financial Services Sector in the Kingdom. We anticipate further consolidation across the industry, coupled with new and innovative tech-based solutions will provide opportunities across the sector.

Education

Additionally, there has been an increase in the value of start-up deals in the Kingdom. In 2019, several big-ticket investments including a $8.6 million investment in Noon Academy co-led by Raed Ventures and Saudi Technology Ventures, marking the largest ever funding round raised by a MENA edtech start-up1.

Start-up Landscape

Saudi Arabia has also been building itself as an entrepreneurial hub. For over a decade, the Badir Program for Technology Incubators has been a centre for start-up support and has helped hundreds of companies to grow and delivered more than SAR2 billion impact on the Saudi economy. Monsha’at (Saudi's General Authority for Small and Medium Enterprises) continues to support the launch of coworking spaces and hubs, raising the skills of Saudi founders, and building a culture of entrepreneurship2.

Further, E-Commerce and FinTech, witnessed an unparalleled spike in demand in 2020, and continued to grow in terms of funding rounds to represent 20% and 10% of all deals in Saudi Arabia, respectively. E-Commerce start-ups raised 45% of total funding in 2020, followed by Transport (10%) and Education (9%). The government also aims to raise the contribution of SMEs to the GDP from 20% to 35% by 20301.

Over the next 15 years, investment in AI alone is forecast to add 12.4% to the country’s GDP2 and with the drive to develop megaprojects across the country, whilst disrupting traditional industries to think digital-first will provide significant technology opportunities across the Kingdom.

The challenge which businesses will need to consider focus around diversifying their processes and operations, re-skilling its people and keeping up with the level of disruption and innovation.

1 2020, Saudi Arabia on Venture Capital Report by MAGNiTT

2 https://www.entrepreneur.com/article/343449